Vietnam has a property ownership rate of almost 90%, but many millennials are struggling to join that group. Rising city property costs, combined with a lack of financing choices, force more people to postpone purchasing their first houses unless they have family backing.

In addition, around 70% of the population do not have a bank account, making it difficult to apply for mortgages. Homebase was launched in 2019 to provide prospective Vietnamese buyers with an alternative to traditional home-buying options.

In November 2021, Homebase had successfully raised $30 million USD from global investors and private equity firms, including Y Combinator, Antler, Partech Partners, VinaCapital, among others.

Here’s what to know about Homebase

Homebase works as a co-investor, purchasing a piece of a property with clients, who then have the choice of purchasing equity from Homebase until they have full ownership, or selling the property before the terms’ end. In the meantime, purchasers pay Homebase monthly deposits that correspond to the company’s ownership and enjoy full access to the property, allowing them to live in or rent it out.

Its contracts span from one month to ten years, and at the contract’s end, buyers may choose to purchase all of the home equity or sell to Homebase. The amount of equity that clients purchase at the beginning varies as well. Homebuyers who use Homebase as an alternative to mortgages, for example, often start with a 20 percent to 30 percent share in the property, whereas more experienced buyers typically start with a 50 percent stake.

Value-added services

Homebase provides a value-added solution for those third parties, allowing them to close more sales by offering a mechanism for clients to obtain finance. Homebase also does due diligence on properties, such as analyzing documents and permits, and has developed an asset assessment model based on current property data, transaction data, and developer information.

An said that the valuation service, which Homebase is developing, is a critical component of the business since it assures purchasers that the company’s incentives are aligned with theirs.

“We stand to risk our investment, too,” Phillip An (COO and Co-founder of Homebase) told TechCrunch.

“Many customers are also first-time buyers and they want more help to find a good property.”

Main product – Buy with Installment

Currently, Homebase offers the Buy with Installment product with an installment payment plan to help customers (even the expats) own any property in Vietnam.

Homebase’ homeownership solution enables buyers to start buying with as little as 10% of the initial down payment, supporting up to 90% of the upfront purchasing value. Most banks in Vietnam offer a maximum of 70% financing, and many foreigners are not eligible to take out a loan. For those, Homebase offers a viable alternative to owning.

Here is a rough overview of how working with Homebase looks like for “Buy with Installment”:

- Step 1: Customers select a home or Homebase can recommend a professional agent to help.

- Step 2: Homebase will pay for the chosen property in cash.

- Step 3: At the start, customers only need to put down a 10% deposit.

- Step 4: Every month, customers will pay a pre-agreed amount that accumulates to the buyback price.

To give more customers the opportunity to own with ease, Homebase offers two payment options, where you can either deposit both the pre-agreed price and the property’s appreciation rates to buy back on time, or you can deposit the appreciation rates only to reduce monthly financial strain.

Contact Homebase’ team for more information on Buy with Installment: Fill in a form here.

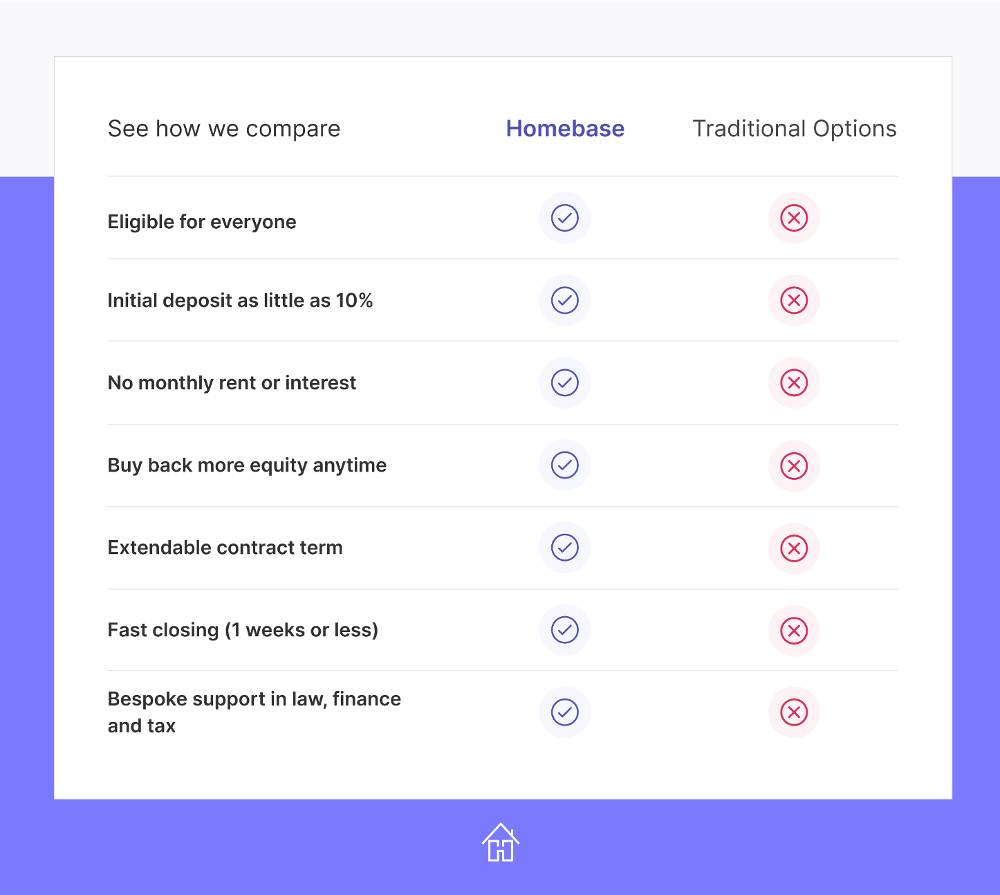

Infographic: Homebase vs. Traditional Mortgages

Closing thoughts

Homebase captures the thriving Vietnamese housing market with its acumen and a strong team to make homeownership more accessible to anyone. You can contact Homebase by phone/Zalo/WA at (+84) 964 245 404 or email at contact@gethomebase.com to start owning in Vietnam with ease.